Blank Indiana State 43931 PDF Template

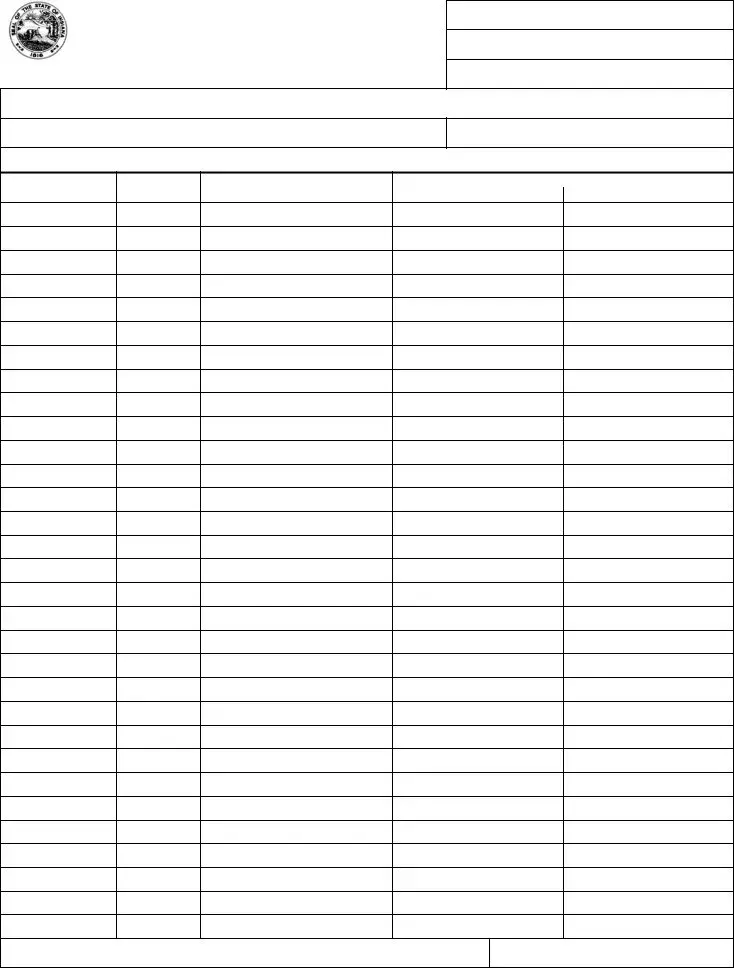

The Indiana State Form 43931 serves as an essential tool for self-employed individuals to report their income and business costs accurately. Designed to streamline the reporting process, this form allows users to provide detailed information about their gross monthly income and associated expenses. It includes sections for the individual's name, type of business, and a breakdown of income received and costs incurred throughout the month. Specifically, the form requires users to document daily income and costs, ensuring a comprehensive overview of financial activity. Additionally, it captures vital case information, such as the case name, case number, and identification number of the caseworker, which helps maintain organized records. By signing and dating the form, self-employed individuals affirm the accuracy of the information provided, contributing to transparency and accountability in their financial reporting.

Form Sample

REPORT OF

State Form 43931 (R4 /

Case name

Case number

Name of caseworker / identification number

This document has been created for the convenience of

Name of

Type of business

DAY OF |

HOURS |

AMOUNT OF |

|

COSTS |

MONTH |

PER DAY |

INCOME RECEIVED |

Type |

Amount |

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

Signature of

Date signed (month, day, year)

Form Specifics

| Fact Name | Details |

|---|---|

| Form Title | REPORT OF SELF-EMPLOYMENT INCOME |

| Form Number | Indiana State Form 43931 |

| Version | R4 / 2-16 |

| Purpose | This form is designed for self-employed individuals to report their gross monthly income and business costs. |

| Governing Law | The form is governed by Indiana state regulations regarding income reporting for self-employed individuals. |

| Required Information | Self-employed individuals must provide their name, type of business, and detailed income and costs for the month. |

| Income Reporting | Individuals must report income received on a daily basis for the entire month. |

| Cost Reporting | Monthly business costs must also be documented, with space for up to 30 entries. |

| Signature Requirement | The form must be signed by the self-employed individual to validate the reported information. |

| Date of Signing | The date must be provided in the format of month, day, and year at the time of signing. |

Fill out Popular Templates

Indiana Oversize Overweight Permits - The Department of Revenue uses Form M-201 to streamline the permit application process, making it quicker and more efficient.

It40 Form - It emphasizes the importance of enclosing Schedule 7 for authorization purposes.

For individuals looking to navigate the complexities of ownership transfer, the Illinois Motorcycle Bill of Sale is often coupled with helpful resources. An informative guide on the Motorcycle Bill of Sale form can be found here, providing clarity on its usage and significance in legal transactions.

Indiana State 50504 - Eligibility criteria detailed in the form must be met for the application to be considered.