Blank Indiana St 105 PDF Template

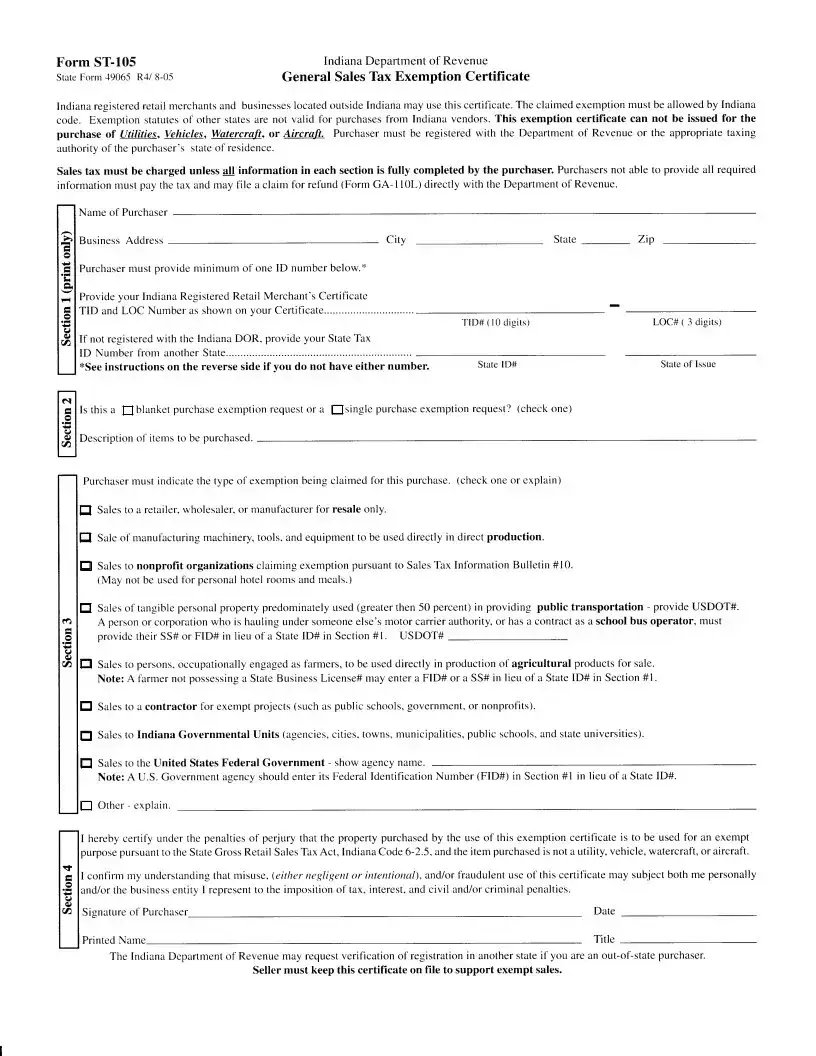

The Indiana ST-105 form, officially known as the General Sales Tax Exemption Certificate, plays a vital role for businesses in Indiana and those located outside the state. This form allows registered retail merchants to claim exemptions from sales tax on certain purchases, provided they meet specific criteria outlined by Indiana law. It is essential to understand that exemptions claimed under this certificate must adhere to Indiana's code; exemptions from other states are not valid for purchases made from Indiana vendors. Notably, the ST-105 cannot be used for the purchase of items such as liquor, vehicles, watercraft, or aircraft. To use this form, purchasers must be registered with the Indiana Department of Revenue or have a valid tax identification number from their home state. If the required information is not fully completed, sales tax will be charged, and the purchaser may need to file a claim for a refund. The form requires details such as the purchaser's name, business address, and tax ID numbers, along with a declaration of the type of exemption being claimed. Understanding the nuances of this form is crucial for businesses to navigate sales tax regulations effectively and avoid potential penalties.

Form Sample

Form |

Indiana Department of Revenue |

StateForm :19065 |

General SalesThx Exemption Certificate |

Indianaregisteredrelail merchantsand businesseslocatedoutsideIndianamay usethis certificate.The claimedexemptionmust be allowedby Indiana code. Exemption slatutesof other statesare not valid tbr purchasesfrom Indiana vendors.This exemption certilicate can not be issued for the purchase of lLili/iqg, Vehicles, Watercraft, or Ai/crafr. Pttrcha.sermust be registered with the Depafiment of Revenue or the appropriate taxing authorityofthe purchaser'sstateof residence.

Sales tax must be charged unless a!! information in each 6ection is fully completed by the purchaser. Purchasersnot able to provide all required informationmust pay the tax and may file a ctaim for refund(Form GA- I

Name of Purchaser

B u s i n e s s A d d r e s s |

C i t y |

P u r c h a s e rm u s t p r o v i d e m i n i m u m o f o n e I D n u n i b e r b e l c l w . t '

Provide your Indiana Registered Retail Merchant's Certificatc TID and LOC Number as shown on your Certificate .

If not registered with the Indiana DOR, provide your State Tax I D N u m b e r f r o m a n o t h e r S t a t e . . . . . .

*See instructions on the reverse side if vou do not have either number .

State _ |

Zip |

T I D # ( l 0 d i g i t s ) |

LOC# ( 3 digits) |

SrarelD# |

Stateof Issue |

HI s t h i s a I b l a n k e t p u r c h a s ee x e m p t i o n r e q u e s to r a I

D e s c r i p t i o no f i l e m s t o b e p u r c h a s e d .

s i n g l e p u r c h a s ee x e m p t i o n r e q u e s t ? ( c h e c k o n e )

Purchasermust indicatethe lype oI exemptionbeing claimedfor this purchase.(checkone or explain)

E

E

E

E

Salesto a retailer,wholesaler,or manufacturerfor resaleonly.

Saleof manufactu ng machinery tools.andequipmentto be useddirectly in direct production.

Salesto nonprofft organizations claimingexemptionpursuantto SalesTax lnformationBullelin #10. (May not be usedfor personalhotel roomsand meals.)

Salesofrangible personalpropertypredominatelyused(greaterthen50 percent)in providing public transportation - provide USDOT#.

Apersonor corporalionwho is baulingundersomeoneelse'smotor carrierauthority,or hasa contractasa schoolbus operator, must providc their SS#or FID# in lieu of a StateID# in Section#1. USDOT# -

E

E

E

Salesto persons,occupationallyengagedasfamers, to be useddirectly in productionof agricultural productsfor sale. Note: A farmernot possessinga StateBusinessLicense#may entera FID# or a SS# in lieu of a StateID# in Section#1.

Salesto a contractor for exemptprojects(suchaspublic $chools,or nonprofits). Sovemment,

Salesto Indiana Governmental Units (agencies,cilies,towns.municipalities,public schools,and slateuniversities).

El

Salesto the United States Federal Government - show agency name .

Note: A U . S . Government asencv should enter its Federal Identification Number (FID#) in Section #1 in lieu of a State ID# .

E O t h e r - e x p l a i n .

Iherebycerlify underthe penaltiesof perjury that lhe propeny purchasedby the useof this exemptioncertificateis to be usedfor an exempt purposepursuanlto theStateCrossRetailSalesTaxAct,

Iconfirm my undeBtandingthat misuse,(?ifrer egligentor intentioral), and/orfraudulentuseofthis certificatemay subjectboth me personally and/orthe businessentity I represenlto the impositionoftax, interest,and civil and/orcriminal penalties.

Signature of Purchaser |

Date |

Printed Name |

Title |

The Indiana Dcpartntent of Revenue may request verification of registration in another state if you are an out - of - state purchaser .

Seller must keep this certificate on file to support exempt sales.

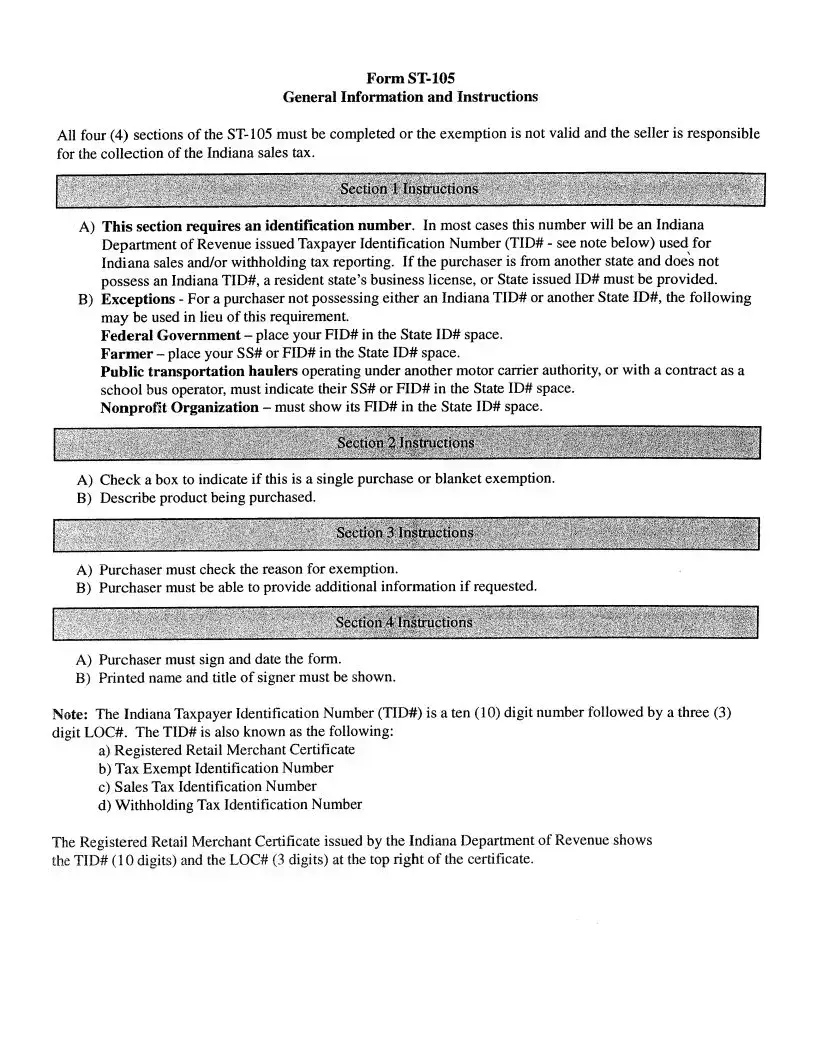

GeneralInfonnation and Instructions

All four (4) sectionsof

A)This sectionrequires an identification number. In mostcasesthis numberwill be anIndiana DeparunentofRevenueissuedTaxpayerldentificationNumber(TID# - seenotebelow) usedfor Indianasalesand/orwithholdingtax reporting. If the purchaseris from anotherstateanddoei not possessanIndianaTID#, a residentstate'sbusinesslicense,or StateissuedID# mustbeprovided.

B)Exceptions- For a purchasernot possessingeitheranIndianaTID# or anotherStateID#, thefollowing

may beusedin lieu of thisrequirement. tr'ederalGovernment- placeyourFID# in theStateID# space. Farmer - placeyour SS#or FID# in theStateID# space.

Public transportation haulersoperatingunderanothermotor carrierauthority,or witb a contractasa

schoolbusoperator,mustindicatetheir SS#or FID# in theStateID# space. Nonprolit Organization- mustshowits FID# in the StateID# space.

A)Check a box to indicateif this is a singlepurchaseor blanketexemption.

B)Describeproductbeingpurchased.

A)Purchasermustcheckthereasonfor exemption.

B)Purchasermustbe ableto provide additionalinformation if requested.

A)Purchasermust sign and date the form.

B)Printednameandtitle of signermustbe shown.

Note: The Indiana TlrxpayerIdentification Number (TID#) is a ten (10) digit number followed by a thtee (3) digit LOC#. The TID# is alsoknown asthe following:

a)RegisteredRetail Merchant Certificat€

b)Tax Exempt Identification Number

c)SalesTax Identification Number

d)Withholding Tax Identification Number

The RegisteredRetailMerchantCertificateissuedby the IndianaDepartrnentofRevenueshows the TID# ( I 0 digits) and the LOC# (3 digits) at the top right of the certificate'

Form Specifics

| Fact Name | Details |

|---|---|

| Purpose of Form | The Indiana ST-105 form serves as a General Sales Tax Exemption Certificate, allowing registered merchants and out-of-state businesses to claim exemptions on certain purchases from Indiana vendors. |

| Governing Law | This form is governed by the Indiana Code, specifically the State Cross Retail Sales Tax Act, Indiana Code 6-2.5. |

| Exemption Limitations | Exemptions cannot be claimed for purchases of utilities, vehicles, watercraft, or aircraft. Only specific types of purchases qualify for the exemption. |

| Completion Requirements | All sections of the ST-105 must be completed accurately. If any required information is missing, the seller must collect the applicable sales tax. |

Fill out Popular Templates

Self Employment Income Form - An essential tool for tracking the financial performance of a solo enterprise, focusing on gross income and monthly expenditures.

Eviction Process Indiana - A precursor to a legal confrontation, enabling landlords to highlight the urgency of regaining property access and settling rent dues.

The Florida Motor Vehicle Bill of Sale form is essential for ensuring a clear and formal record of vehicle ownership transfer. It acts as a verification tool, serving not just as a receipt but as a legal document that validates the sale and purchase process in Florida. Understanding its significance is pivotal for tax assessments, title transfers, and providing proof of ownership in legal matters, which is why resources like UsaLawDocs.com can be incredibly helpful.

Transcript Iu - Protection of student privacy is a central feature of the Indiana Transcript Request form, adhering to federal FERPA regulations.