Blank Indiana St 103Dr PDF Template

The Indiana ST-103DR form serves as a crucial tool for gasoline distributors operating within the state. Designed by the Indiana Department of Revenue, this form requires completion even in the absence of transactions, emphasizing its importance in maintaining accurate tax records. It captures essential information, including the taxpayer's identification numbers, business name, and contact details. Additionally, the form distinguishes between qualified and non-qualified distributors, guiding users in selecting the appropriate sales tax return to file. Sections I and II of the form focus on the purchase and sale of fuel, respectively. Distributors must detail their suppliers, including names, addresses, and federal identification numbers, along with the total gallons purchased and the prepaid sales tax paid. Conversely, the second section requires distributors to list their customers, detailing the total gallons sold, including any exempt gallons, and the prepaid sales tax collected. The form must be submitted monthly, with specific deadlines in place to ensure compliance. Accurate completion and timely filing of the ST-103DR are essential for distributors to fulfill their tax obligations and avoid potential penalties.

Form Sample

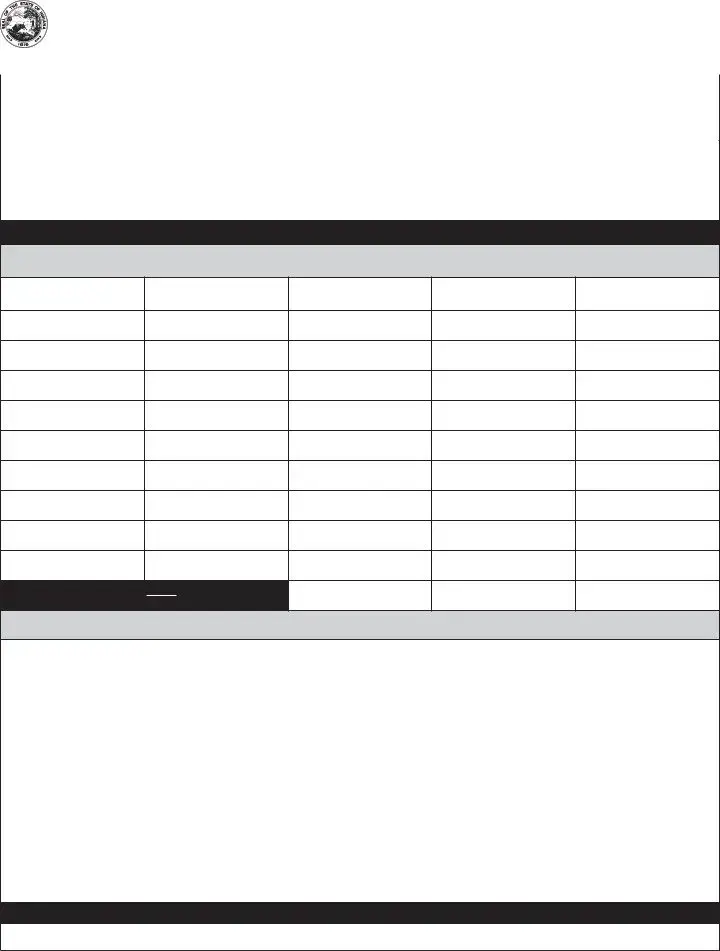

|

Form |

|

Indiana Department of Revenue |

|

|||

|

Recap of Prepaid Sales Tax by Distributors |

||||||

|

State Form 51068 |

||||||

|

|

|

|

|

|

|

|

|

(R4 / |

IMPORTANT: This form must be fi led even when no transactions have occured. |

|||||

|

|

|

|

|

|

||

1. Taxpayer Identifi cation Number |

|

2. For Tax Period (month/year) |

|

3. Federal Identification Number |

|||

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

4. |

Taxpayer Name |

|

|

5. Doing Business as Name (DBA) |

|

6. Telephone Number |

|

|

|

|

|

|

|

||

7. |

Street Address, City, State Zip Code |

|

|

8. Gasoline Distributor Status (Check One) |

|||

|

|

|

|

|

Qualifi ed Distributor □ |

||

|

|

|

|

|

|||

9. |

Which sales tax return are you filing (Check One) |

|

|||||

|

|

|

NOTE: THIS FORM MUST BE PRINTED OR TYPED |

|

|||

|

|

|

|

||||

Section I: |

|

From Whom Did You Buy Fuel? |

|

||||

10. Name of Supplier

11. Address of Supplier

12.Supplier Federal ID Number

13.Total Gallons Purchased

14.Prepaid Sales Tax Paid to Supplier

Note: You Must Complete BOTH Sides of this Form

15. Grand Totals

Instructions for Section I

1.Provide your Indiana Taxpayer Identifi cation Number (TID).

2.What Tax Period (month/year) Note: This report is due the last day of the month following the reporting period.

3.Enter your Federal Identifi cation Number (FID).

4.Provide the Taxpayer’s legal name.

5.List the Doing Business as Name for your company.

6.Please list your company’s telephone number including area code.

7.Provide your business address.

8.Check your Distributor Status.

9.Check which tax return you are filing.

10.List the names of the companies you purchase from.

11.List the address of the companies you purchase from.

12.List your supplier’s Federal Identification Number.

13.List total gallons purchased from each supplier.

14.Provide the amount of prepaid sales tax you paid each supplier.

15.Total the number of gallons purchased and the amount of prepaid sales tax paid for the reporting month.

This report must be fi led MONTHLY. It is due on the last day of the month following the reporting period.

□Please check this box if your business has permanently closed and provide the closed date. ____/____/____

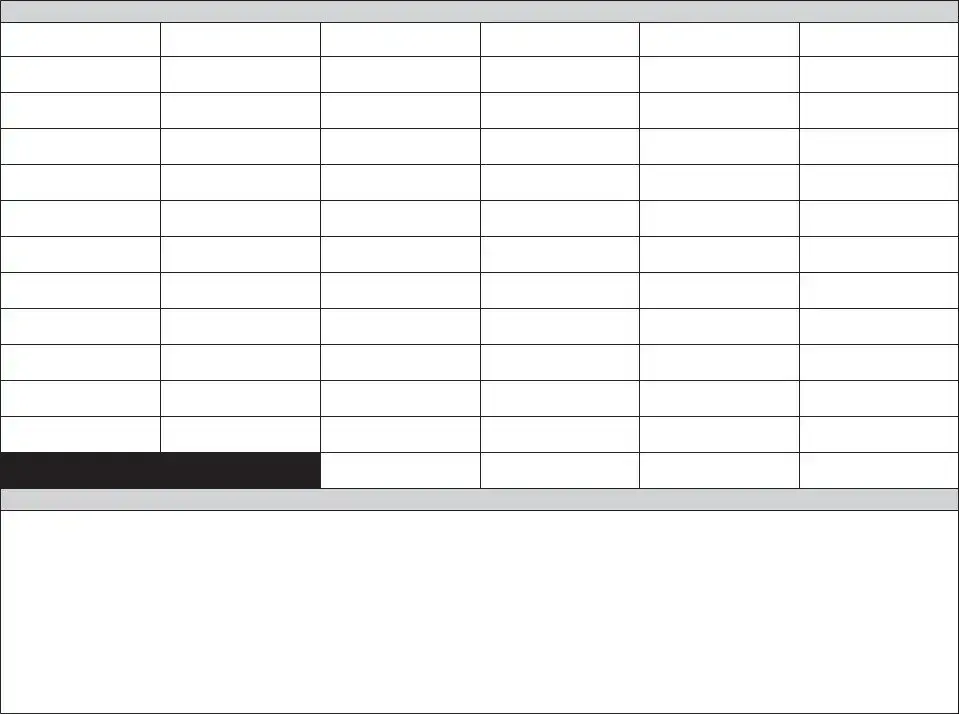

SECTION II |

To Whom Did You Sell Fuel? |

16. Customer’s Name

17. Customer’s Address

18.Customer’s Federal ID Number

19. Total Gallons Sold

20. Exempt Gallons Sold

21. Prepaid RST Collected

All Gallons EXEMPTED and TAXED must be shown

22. Total

Instructions for Section II

16.List your Customer’s Name. (Attach additional sheets if necessary).

17.List your Customer’s Address.

18.List your Customer’s Federal ID Number.

19.List the total gallons of gasoline sold for this month to each customer.

20.List the total tax exempt gallons sold to each customer.

21.List the total amount of Prepaid Sales Tax collected for this month from each customer.

22.Total the amounts of all columns and give the total gallonage and amount collected here.

I declare, under penalties of perjury that this is a true, correct and complete report.

Mail to: Indiana Department of Revenue Excise Tax

P.O. Box 6114 Indianapolis, IN

______________________________________________ |

_____________________________________________ |

__________________________ |

________________ |

Printed Name |

Authorized Signature |

Title |

Date |

Form Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The Indiana ST-103DR form is used to report prepaid sales tax by distributors. It must be filed even if no transactions occurred during the reporting period. |

| Filing Frequency | This form is required to be filed monthly, with the deadline being the last day of the month following the reporting period. |

| Required Information | Taxpayers must provide their Taxpayer Identification Number, Federal Identification Number, and details about fuel purchases and sales, including customer information. |

| Governing Law | The form is governed by Indiana Code Title 6, Article 2.5, which pertains to the collection and reporting of sales tax in the state. |

Fill out Popular Templates

Qma License - Details on contacting the Indiana State Department of Health for inquiries related to QMA certification and in-service education.

Written Permission Printable Hunting Permission Form - It includes spaces for important details like the hunter’s name, the property location, and the duration of the permission granted.

For those seeking to secure their sensitive information, the importance of a well-structured Non-disclosure Agreement is paramount. A thorough understanding of the Non-disclosure Agreement can protect your interests in various personal or business transactions. For further guidance, visit the detailed guide on the Non-disclosure Agreement.

Indiana Oversize Overweight Permits - The form outlines that, barring certain exceptions, changes to permits are restricted after the third day from the issuance date.