Blank Indiana St 103 PDF Template

The Indiana St 103 form plays a crucial role in the sales tax reporting process for businesses operating within the state. This form is designed for record-keeping purposes only and should not be submitted to the Indiana Department of Revenue. It encompasses several key components, including the total sales for the specified period, exemptions and deductions, and the calculation of taxable sales. Additionally, the form requires businesses to determine the total tax due by applying the current sales tax rate to their taxable sales figure. Important sections also address discounts for timely payments, use tax for items purchased without sales tax, and any interest or penalties incurred for late payments. Businesses must accurately complete the form to ensure compliance and avoid potential penalties. Furthermore, the Indiana St 103 provides a mechanism for reporting electronic funds transfers, making it essential for those who opt for electronic payment methods. Understanding the intricacies of this form is vital for business owners to maintain accurate financial records and meet their tax obligations efficiently.

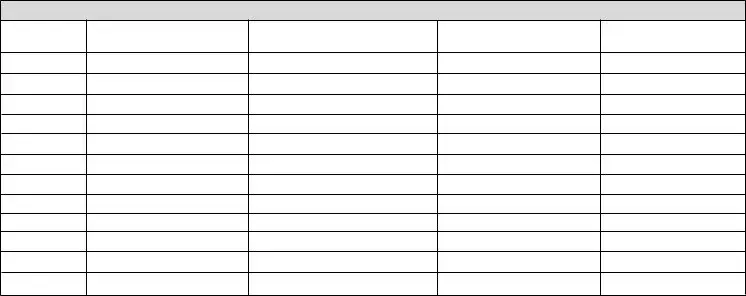

Form Sample

For your records only. Do not send to the Indiana Department of Revenue.

Month |

Amount of |

Amount of |

Date Paid |

Check Number |

|

Tax Due |

Tax Paid |

||||

|

|

January

February

March

April

May

June

July

August

September

October

November

December

Sales Tax Vouchers and/or Electronic Funds Transfer Credit Recap |

Filing Status |

Instructions for completing Form ST−103 |

All |

|

1.Total Sales − Enter the total sales from activities for the period specified on the form. Do not include any other periods of sales activities. Sales activities include retail, wholesale, manufacturing, and out−of−state sales. The figure entered on this line cannot include sales tax.

2.Exemptions/Deductions − Enter the total amount of exemptions and/or deductions for the period.

3.Taxable Sales − Subtract Line 2 from Line 1.

4.Total Tax Due − Multiply Line 3 by the Current Sales Tax Rate to compute the sales tax due. See the voucher for the current sales tax rate.

5.Discount (Collection Allowance) − Use this line only if your voucher is postmarked or your EFT payments were made on or before the due date. The discount is available only when the payment is remitted timely. Your collection allowance is .0083. It is based on your total sales tax liability accrued during July 1, 2006 through June 30, 2007. For further information, please refer to this Web site: www.in.gov/dor/reference/notices/pdfs/dn25.pdf

Utilities are not eligible for the discount.

6.Use Tax Due − Use tax is due on any purchase(s) where no sales tax was paid and the property was not held for resale or for another exempt purpose. If an item is (a) removed from inventory for personal use, (b) used as a giveaway, or (c) used as a display model or promotional item not for sale, and no sales tax was paid when purchased, then use tax is due. Multiply your cost by the Current Use Tax Rate. See the voucher for the current use tax rate.

7.Interest Due − Payments made after the due date are subject to interest. Interest is computed from the tax due date to the date payment is made. Interest must be computed on the total of Line 4 plus Line 6. Do not compute interest on any late payment penalty entered on Line 8. If you make a late payment by EFT, do not calculate and enter interest due on this line. An assessment notice for late payment interest and penalty due will be issued automatically.

8.Penalty Due − Payments made after the due date are also subject to a 10 percent penalty. The penalty must be computed by multiplying 10 percent times the total of Line 4 plus Line 6, or $5.00, whichever is greater. Do not compute penalty on the interest amount due entered on Line 7. If you make a late payment by EFT, do not calculate and enter penalty on this line. An assessment notice for late payment interest and penalty will be issued automatically. EFT taxpayers do not use Line 7 or Line 8 to compute penalty and interest.

9.Payment Previously Made (EFT) − Enter the total amount paid by EFT for all months within the quarter. If you are mailing this recap before you have initiated the final EFT payment for the quarter, you should claim the EFT payment you will be initiating on this line. Do not enter the final EFT payment for the quarter on Line 10.

10. Amount Due − Add Lines 4, 6, 7 and 8 and subtract Lines 5 and 9. Pay this amount. Do not send cash.

EFT taxpayers must remit payments on or before the due date specified by the department−assigned filing frequency.

Although the EFT recap is filed quarterly, the payments may be due monthly by the twentieth or thirtieth depending on the filing frequency.

If you begin paying by EFT in the middle of a quarter, only include the months paid by EFT on the recap.

Interested in Filing Electronically or Online?

Visit www.INtax.in.gov to learn about Indiana’s online filing program, INtax. You may register to file returns and make tax payments electronically online. INtax may be used to file taxes for Indiana sales tax, withholding tax, and tire fee.

For information about Indiana’s other electronic payment options, visit www.in.gov/dor and select Electronic Services.

Form Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Indiana ST-103 form is used for reporting sales tax and is for your records only. It should not be sent to the Indiana Department of Revenue. |

| Governing Law | This form is governed by Indiana Code Title 6, Article 2.5, which covers sales and use tax regulations. |

| Filing Frequency | Although the ST-103 recap is filed quarterly, payments may be due monthly, depending on your assigned filing frequency. |

| Sales Tax Calculation | To determine the total tax due, multiply taxable sales by the current sales tax rate. This rate can be found on the voucher. |

| Discount Eligibility | A collection allowance of 0.83% is available if payments are made on or before the due date. Utilities do not qualify for this discount. |

| Use Tax | Use tax applies to purchases where no sales tax was paid. This includes items removed from inventory for personal use. |

| Penalties for Late Payment | Payments made after the due date incur a 10% penalty on the total tax due, or a minimum of $5.00, whichever is greater. |

Fill out Popular Templates

It40 Form - The IT-40 form facilitates direct allocation of refunds to taxpayer accounts, including Hoosier Works MC.

Indiana Entertainment Permit - By specifying the intended occupant load, organizers can work with authorities to ensure maximum safety standards are met.

When engaging in transactions involving personal property in Florida, it is essential to utilize a Florida Bill of Sale form to ensure that both parties are protected and all terms are documented. This form not only signifies the transfer of ownership but also establishes a clear record that can be referenced in the future. To obtain a properly formatted document, you can visit UsaLawDocs.com, which provides templates and guidance for completing the form correctly.

Indiana Registered Retail Merchant Certificate - By completing the BT-1, businesses take a significant step towards formal recognition and compliance within Indiana's tax ecosystem.