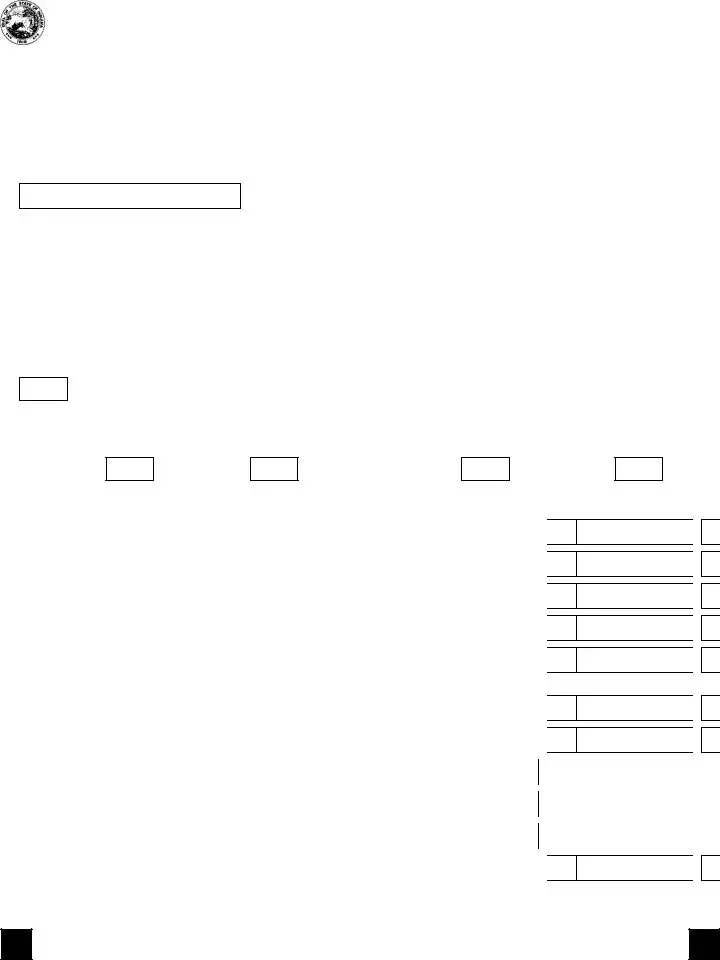

Blank Indiana It 40 PDF Template

The Indiana IT-40 form is a crucial document for residents filing their state income tax returns. This form is designed for full-year residents and must be submitted by April 15 each year. It requires personal information, including Social Security numbers and addresses, as well as details regarding income and deductions. Taxpayers must report their federal adjusted gross income, which is the starting point for calculating Indiana income tax. The form also includes sections for Indiana add-backs, deductions, and exemptions, allowing taxpayers to adjust their income accordingly. Additionally, it calculates state and county taxes owed, as well as any potential credits that may apply. If a refund is due, taxpayers can choose direct deposit options for convenience. Conversely, if taxes are owed, the form provides clear instructions on how to make payments. Understanding the IT-40 form is essential for ensuring compliance with Indiana tax laws and maximizing potential refunds.

Form Sample

Form

State Form 154

(R21 /

Your Social Security Number

Your first name

2022 |

Indiana |

Due April 18, 2023 |

|

Individual Income Tax Return |

|

||

|

|

If filing for a fiscal year, enter the dates (see instructions) (MM/DD/YYYY):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Place “X” in box |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

from |

|

|

|

|

|

|

|

|

|

to: |

|

|

|

|

|

|

|

|

|

|

|

if amending |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Social |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Security Number |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Place “X” in box if applying for ITIN |

|

|

|

Place “X” in box if applying for ITIN |

|||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

Initial |

|

|

Last name |

|

|

|

|

|

|

|

|

Suffix |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If filing a joint return, spouse’s first name |

Initial |

|

Last name |

|

|

|

|

Suffix |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Present address (number and street or rural route) |

|

|

|

|

|

|

Place “X” in box if you are |

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

married filing separately. |

|

||

|

|

|

|

|

|

|

|

|

|

|||

City |

|

|

|

|

|

State |

|

ZIP/Postal code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country

Enter below the

County where you lived

County where you worked

County where spouse lived

County where spouse worked

Round all entries

1. |

Enter your federal adjusted gross income from your federal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

income tax return, Form 1040 or Form |

|

1 |

|||||

2. |

Enter amount from Schedule 1, line 7, and enclose Schedule 1 ________ |

|

2 |

|||||

Indiana |

|

|||||||

|

|

|

||||||

3. |

Add line 1 and line 2 ____________________________________________________________ |

|

3 |

|||||

|

|

|

||||||

4. |

Enter amount from Schedule 2, line 12, and enclose Schedule 2 _______ Indiana Deductions |

|

4 |

|||||

|

|

|

||||||

5. |

Subtract line 4 from line 3 ________________________________________________________ |

|

5 |

|||||

6. |

Complete Schedule 3. Enter amount from Schedule 3, line 7, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

and enclose Schedule 3 ______________________________________ Indiana Exemptions |

|

6 |

|||||

|

|

|

||||||

7. |

Subtract line 6 from line 5 ____________________________ Indiana Adjusted Gross Income |

|

7 |

|||||

8. |

State adjusted gross income tax: multiply line 7 by 3.23% (.0323) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(if answer is less than zero, leave blank) ____________________ |

8 |

|

|

.00 |

|

||

9. |

County tax. Enter county tax due from Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(if answer is less than zero, leave blank) ____________________ |

9 |

|

|

.00 |

|

||

|

|

|

|

|

|

|

|

|

.00

.00

.00

.00

.00

.00

.00

10. |

Other taxes. Enter amount from Schedule 4, line 4 (enclose schedule) |

|

|

|

|

|

|

|

10 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|

|

11. |

Add lines 8, 9 and 10. Enter total here and on line 15 on the back ___________ Indiana Taxes |

|

11 |

|||||

|

||||||||

.00

*15122111694*

15122111694

12. |

Enter credits from Schedule 5, line 12 (enclose schedule) ___ |

|

|

|

|

|

|

|

|

|

|

||

12 |

|

|

.00 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Enter offset credits from Schedule 6, line 8 (enclose schedule) |

13 |

|

|

.00 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Add lines 12 and 13 ______________________________________________ Indiana Credits |

|

|

|

|

||||||||

14 |

|

.00 |

|||||||||||

15. |

Enter amount from line 11___________________________________________ Indiana Taxes |

|

|

|

|

||||||||

15 |

|

.00 |

|||||||||||

|

|

|

|

|

|

|

|

||||||

16. |

If line 14 is equal to or more than line 15, subtract line 15 from line 14 (if smaller, skip to line 23) |

16 |

|

.00 |

|||||||||

|

|

|

|

|

|

|

|

||||||

17. |

Enter donations from Schedule |

17 |

|

.00 |

|||||||||

18. |

Subtract line 17 from line 16 __________________________________________Overpayment |

|

|

|

|

||||||||

18 |

|

.00 |

|||||||||||

19. |

Amount from line 18 to be applied to your 2023 estimated tax account (see instructions). |

|

|

|

|

||||||||

|

Enter your county code |

|

county tax to be applied _ $ |

|

|

|

|

|

|

|

|

|

|

|

|

a |

|

|

.00 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s county code |

|

county tax to be applied _ $ |

b |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indiana adjusted gross income tax to be applied _________ $ |

c |

|

|

.00 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

Total to be applied to your estimated tax account (a + b + c; cannot be more than line 18)_____ |

19d |

|

.00 |

|||||||||

20. |

Penalty for underpayment of estimated tax from Schedule |

|

|

|

|

||||||||

20 |

|

.00 |

|||||||||||

|

Refund: Line 18 minus lines 19d and 20. Note: If less than zero, see line 23 |

|

|

|

|

|

|||||||

21. |

___ Your Refund |

21 |

|

.00 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22.Direct Deposit (see instructions)

|

a. Routing Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

b. Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

c. Type: |

|

Checking |

|

|

Savings |

|

|

Hoosier Works MC |

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

d. Place an “X” in the box if refund will go to an account outside the United States |

|

|

|

|

|

|

|||||||||||||||||||||||

23. |

If line 15 is more than line 14, subtract line 14 from line 15. Add any amount to this on line 20 |

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||

|

(see instructions) _____________________________________________________________ |

23 |

|

.00 |

||||||||||||||||||||||||||

24. |

Penalty if filed after due date (see instructions) ______________________________________ |

|

|

|

|

|||||||||||||||||||||||||

24 |

|

.00 |

||||||||||||||||||||||||||||

25. |

Interest if filed after due date (see instructions) ______________________________________ |

|

|

|

|

|||||||||||||||||||||||||

25 |

|

.00 |

||||||||||||||||||||||||||||

|

Amount Due: Add lines 23, 24 and 25______________________________ Amount You Owe |

|

|

|

|

|||||||||||||||||||||||||

26. |

26 |

|

.00 |

|||||||||||||||||||||||||||

|

Do not send cash. Make your check or money order payable to: |

|

|

|

|

|||||||||||||||||||||||||

|

Indiana Department of Revenue. See instructions if paying with a credit card. |

|

|

|

|

|||||||||||||||||||||||||

Sign and date this return after reading the Authorization statement on Schedule 7. Remember to enclose Schedule 7.

_____________________________________________________ |

_________________________________________________ |

||

Signature |

Date |

Spouse’s Signature |

Date |

•Mail payments to: Indiana Department of Revenue, P.O. Box 7224, Indianapolis, IN

•Mail all other returns to: Indiana Department of Revenue, P.O. Box 40, Indianapolis, IN

*15122121694*

15122121694

Form Specifics

| Fact Name | Details |

|---|---|

| Form Purpose | The IT-40 form is used for filing individual income tax returns for full-year residents of Indiana. |

| Filing Deadline | Returns must be filed by April 15 of the year following the tax year. |

| Governing Law | This form is governed by Indiana Code Title 6, Article 3, which outlines state income tax regulations. |

| Federal AGI Requirement | Taxpayers must enter their federal adjusted gross income from their federal return, Form 1040 or 1040-SR. |

| County Codes | Taxpayers need to provide county codes for where they lived and worked as of January 1, 2020. |

| Joint Filing | Married couples can file jointly, but they must provide both spouses' information and Social Security numbers. |

| Tax Calculation | Indiana adjusted gross income tax is calculated at a rate of 3.23% on the adjusted gross income. |

| Credits and Deductions | Taxpayers can claim various credits and deductions, which must be documented with additional schedules. |

| Refund Process | If there is an overpayment, taxpayers can apply for a refund or apply it to their estimated tax for the next year. |

| Payment Instructions | Payments should be made payable to the Indiana Department of Revenue, and cash should not be sent. |

Fill out Popular Templates

Indiana Secretary of State Annual Report - Completing and submitting this report is a statutory requirement for entities operating within the state of Indiana.

The Arizona University Application form is a crucial document for students seeking undergraduate admission to Arizona State University, Northern Arizona University, or the University of Arizona. It includes a request for a waiver of the application fee for Arizona residents facing financial hardship. For more information about the application process and to access the necessary forms, visit arizonapdfforms.com/arizona-university-application, as understanding this form and its requirements is essential for a smooth application process.

Indiana Unemployment Pay - Employers can mitigate manual processing delays by properly designating preparers as correspondence agents, ensuring forms are timely and correctly submitted.