Blank Entity Annual Report Indiana PDF Template

The Entity Annual Report, commonly referred to as Form E-1, is a crucial document for organizations operating in Indiana, serving as a key tool for ensuring transparency and accountability in financial reporting. This form must be filed within thirty days following the conclusion of an entity's fiscal year, as mandated by state regulations. It plays a vital role in determining the audit requirements that apply to various entities under Indiana Code. The report gathers essential information, including the legal name, federal identification number, and contact details of the organization, as well as the name and title of the operating officer. Additionally, it requires a detailed account of financial activities, such as government funds received and disbursed during the year, along with total disbursements. Organizations must also indicate whether they are filing for the first time and certify the accuracy of the information provided. This report not only helps in assessing the financial health of the entity but also aids the State Board of Accounts in deciding the level of audit scrutiny necessary. By capturing the purpose and governing structure of the organization, the Entity Annual Report fosters a deeper understanding of how public funds are managed and utilized, ultimately promoting good governance and public trust.

Form Sample

ENTITY ANNUAL REPORT |

STATE BOARD OF ACCOUNTS |

|

|

|

302 WEST WASHINGTON STREET |

Form |

ROOM E418 |

|

Prescribed by State Board of Accounts |

INDIANAPOLIS, INDIANA |

|

Note: |

The Entity Annual Report (Form |

Telephone: (317) |

|

the audit requirements placed on your entity by IC |

Fax: (317) |

|

File report within thirty (30) days of the close of your entity's |

Web Site: www.in.gov/sboa |

|

fiscal year end. Instructions for completing Form |

|

|

included in the attached memorandum |

Page 1 of 2 |

Entity's Fiscal Year End

______ ______ ______

Month Day Year

OFFICE USE ONLY

SBA NO: _____________

Audit Determination:

____________ Complete

____________ Waived

Legal Name: |

|

Federal ID No: |

|

|

|

|

|

||

D/B/A: |

|

Business Phone No: ( ) |

||

|

|

|

|

|

Street Address: |

|

|

|

|

|

|

|

|

|

City: |

County: |

State: |

Zip Code: |

|

|

|

|

|

|

Name of Operating Officer: |

|

Title: |

|

|

|

|

|

||

|

TYPE OF ORGANIZATION |

LEGAL STATUS |

||

|

|

|

|

|

_________ Corporation |

_________ ASSOCIATION |

_________ For Profit |

|

|

_________ Partnership |

_________ INDIVIDUAL |

_________ |

|

|

|

|

|

|

|

|

|

FINANCIAL INFORMATION |

|

|

|

|

|

||

1. |

Government funds received during year (Detailed on Page 2) |

$__________________ |

||

2. |

Government funds disbursed during year |

|

$__________________ |

|

3. |

Entity's total disbursements (or expenditures) for the year |

$__________________ |

||

4. Percent of government funds disbursed to entity's total |

|

|

|

||

disbursements (or expenditures) (Line 2 / 3) |

_________________ % |

||||

This information is reported on the ___________ cash basis ___________ accrual basis. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Is this the initial Form |

__________ No |

__________ |

|||

|

|

|

|

|

|

CERTIFICATION: This is to certify that the data contained in this report is accurate to the best of my |

|||||

knowledge and belief. |

|

|

|

||

Signature:________________________________ |

Title __________________________ |

||||

Printed Name: ____________________________ |

Date Signed: ___________________ |

||||

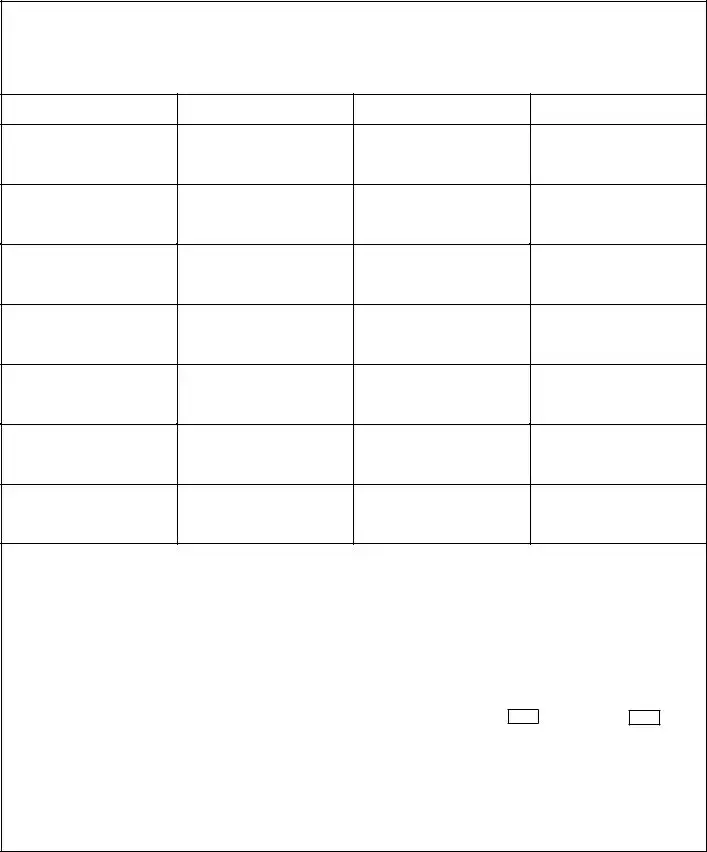

Page 2 of 2

DETAIL OF GOVERNMENT FUNDS RECEIVED

List the government funds received during the year by agency, address, program title and amount received. Attach additional sheets if necessary.

GOVERNMENT AGENCY

ADDRESS

PROGRAM TITLE

AMOUNT RECEIVED

Date organization was founded: _________________________________________________________________

Describe organization's purpose:_________________________________________________________________

___________________________________________________________________________________________

Describe organizational governing structure:________________________________________________________

___________________________________________________________________________________________

Have you ever been audited by an Independent Public Accountant (IPA)? Yes ___________ No ___________

If so, what was the last fiscal year audited? ________________________________________________________

Name and address of IPA that conducted audit: _____________________________________________________

___________________________________________________________________________________________

Form Specifics

| Fact Name | Details |

|---|---|

| Form Name | Entity Annual Report (Form E-1) |

| Governing Law | IC 5-11-1-9 |

| Filing Deadline | Reports must be filed within 30 days of the entity's fiscal year end. |

| Contact Information | State Board of Accounts, 302 West Washington Street, Room E418, Indianapolis, IN 46204-2765 |

| Phone Number | (317) 232-2513 |

| Fax Number | (317) 232-4711 |

| Website | www.in.gov/sboa |

| Types of Organizations | Includes Corporation, Association, Partnership, Individual, For-Profit, and Not-For-Profit. |

| Financial Reporting Basis | Entities can report on a cash basis or an accrual basis. |

| Certification Requirement | The report must be certified for accuracy by the operating officer of the entity. |

Fill out Popular Templates

Indiana St 103 - The form’s guidance on exemptions and deductions helps businesses identify savings opportunities in their tax calculations.

In Florida, using a Bill of Sale form ensures clarity and legality in the transfer of personal property ownership. This document not only acts as proof of purchase but also outlines the agreement between the involved parties, making it essential for various transactions, particularly in vehicle and boat registrations. For comprehensive templates and guidance on this process, you can visit UsaLawDocs.com.

Indiana State 50181 - The secured party's information section ensures all parties claiming an interest are correctly identified.